The Muscular Dystrophy Association’s 2022 Taxes Tell All

The Muscular Dystrophy Association has gone into full fundraising mode the past couple of months, with Fill The Boot events scheduled all over the country. You would think, maybe after news came out about the $6 million MDA gave to the International Association of Fire Fighters, they wouldn’t do that again and the money would actually go to help those with neuromuscular diseases, as MDA claims.

Well…

Taking a look at the IAFF’s latest LM-2, we see that MDA made three equal payments to them between 2021 and 2022 totaling $487,500. In 2022, MDA’s payments to the IAFF totaled $325,000. That money could have funded 72 hours of research, or 13,000 flu shots — that is, before MDA stopped funding flu shots for its clients. Or, since they talk about camp so much, it could have paid for 162 campers to attend. This is assuming in-person camps are still occurring, of course.

So basically, money that fire fighters raised was going to the IAFF — which accounts for less than a third of the fire fighters in the U.S. And even fire fighters who are IAFF members aren’t happy about this.

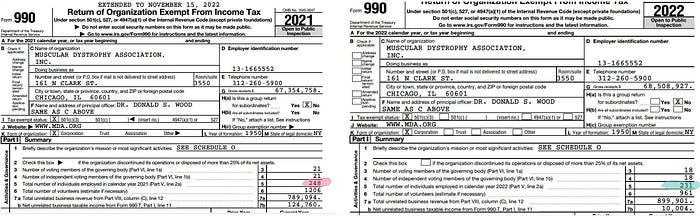

But there are even more interesting things to find in MDA’s 2022 taxes, which were just posted on their site last week.

Let’s start with the number of people employed by MDA. In 2021 it was 248. In 2022 it was 231. Fewer employees probably means less paid out in salaries, benefits and compensation, right?

Not for MDA. They ended up spending over $24 million on their 231 employees, which is up nearly $4 million since 2021. Even MDA President and CEO Donald Wood scored himself a hefty $88,560 raise, making over half a million dollars this year. That doesn’t include the “other” compensation he received in the amount of $26,637.

Speaking of half a million, know what decreased by more than that? The amount of money MDA spent on research grants. (Remember, MDA does not fund research. They fund research grants). In 2021 the amount for grants was $13,666,745. In 2022, it was $13,032,682.

So they raised salaries by nearly $4 million, but spent $634,063 less on things like research — the things they say they actually pay for. They spent almost double on employee salaries and benefits than they did on research grants.

I would love to say I’m surprised, but sadly, I’m not.

Another interesting thing I found on MDA’s 2022 990 was a payment of $390,619 to MWW Group, LLC. For those of you who read my first article, you might remember that name. MWW is a PR firm which, at the time of that article, called itself the PR firm that helps “in a time of crisis.” This is also the same MWW that repeatedly, almost daily, kept viewing my profile and my posts on LinkedIn. The timing of it was very suspect, leading me to believe MDA had hired them — at least somewhat — to keep tabs on what I wrote about them. This was all speculation on my part, but now we have proof they were indeed hired by MDA.

Before filling the boot or making any type of donation to the Muscular Dystrophy Association, please remember where their taxes showed you donations are going — and where they’re not going.